life insurance for children

It's a plan for their life — not their death

Why is child life insurance an affordable investment in your child’s future?

- It comes with a cash value* that grows with your child1 (learn more)

- You'll never find a cheaper time to buy than now (here's why)

- Access to Serenia Life member benefits – like a baby bonus, post-secondary scholarship, and more... (browse benefits)

- Save up to $500 off on first-year payments (learn more)

An investment that grows with your child

Buying a whole life policy for your child provides them with lifetime protection, and a cash value that grows over time. This investment component can be accessed later in life – to help pay for post-secondary education, a wedding, or a down payment on a home.

20-Pay Whole Life Policy benefits include:

- Serious potential for growth

- Only 20 years of payments, but a lifetime of protection

- Access to member benefits that support your family & community

Susan and Lemar

Susan is looking for a permanent insurance solution for her 6-month-old son, Lemar.

Overview

- Susan has a maximum budget of $100/month

- She is looking for a policy that will grow as her son does

- She wants a policy with no payments required when her son is an adult

- She wants to ensure that her son's insurance continues even if she passes away

Solution: 20-Pay Whole Life Policy for $50,000

Total Monthly Premiums: $61.38

(This premium includes the Owner Waiver Death and Disability Benefit for a female, age 35)

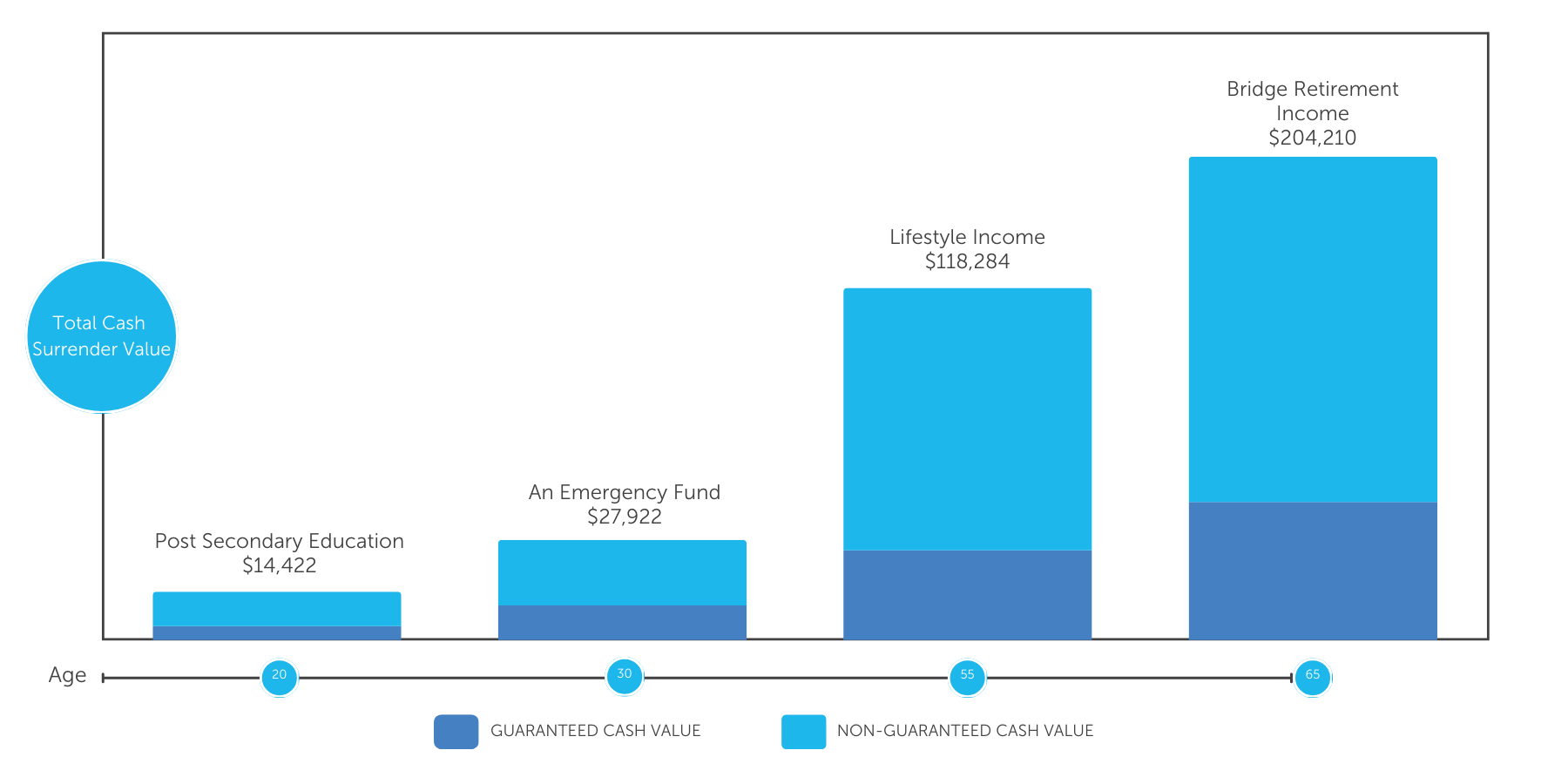

Lemar's Policy Growth Potential Over His Lifetime

For illustration purposes only, as of December 2024. Age 0 based on male regular rates, paid up additions dividend option, and on $50,000 initial insurance coverage and current dividend scale. Future performance will be different than illustrated due to the variability of the dividend. All numbers in Canadian dollars. Current monthly premium, age 0 is $57.15 payable for 20 years. The policy is "paid up" at age 20. Susan is 35 years old, so the monthly premium of $4.23 is added to the monthly total of $61.38.

UP TO $500 IN SAVINGS!

Save on all first-year life insurance policies with Serenia Life.

See our terms and conditions below. 4

Serenia Life's Exclusive Member Benefits5

$1,000 Scholarship

Take advantage of a one-time $1,000 scholarship towards any year of a full-time diploma, undergrad degree, or graduate program.

Fundraiser Support

Apply to receive up to $300 in seed money to get your child started, plus a post-event donation of $100-$300 to the cause you're supporting.

Bereaved Child

To help provide financial stability to children whose parent(s) have died too soon via $500 in monthly support.

Babysitter Training

Give your 11-15 year-old the opportunity to acquire caregiving skills through an accredited Canadian Babysitting course.

Bundles of Joy

You give your baby the gift of life insurance, and we'll send you a $100 baby bonus. Just be sure to purchase the policy before baby turns 1!

Safe Communities

Keep kids in your community safe with a safety kit and safety sign that reminds drivers to slow down when neighbourhood children are at play.

Free Online Will & Power of Attorney Benefit

Serenia Life Financial has partnered with Willful® to give members the opportunity to create their will and appoint power of attorneys (POAs) simply, quickly – and at no cost. Willful is a digital estate planning platform whose easy step-by-step process can be done online in less than 20 minutes.

1 Cash values are accessible via a withdrawal, policy loan or surrender. These may be subject to taxation and a tax slip may be issued. Accessing the cash value of the policy will reduce the available cash surrender value and death benefit.

2 Dividends are not guaranteed and are paid based on the overall experience of Serenia Life Financial, considering all the risk factors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the participating account as well as mortality, expenses, taxes, lapses, withdrawals, and other experience of the participating block of policies. They have the potential to increase the value of your policy above the guaranteed amount, depending on the dividend option selected.

Additional Deposit Option allows clients to pay an additional premium to purchase paid-up life insurance on the policy. This optional payment is in addition to the required insurance premium. With Additional Deposit Option, clients can enjoy the potential of accelerated tax-preferred growth within their policy. We will not accept an additional premium if it will cause the policy to lose its tax-exempt status.

3 This optional benefit is available if you're purchasing life insurance for your child. This benefit ensures your child's life insurance coverage remains in the event event of your death, or if you become totally disabled, for a period of at least 6 consecutive months.

4 All life insurance policies purchased will receive 25% off their first-year premium, up to $500. Clients paying monthly will have premiums waived for the first 3 months or up to $500, whichever comes first. Clients paying quarterly will have their first premium payment waived or reduced by $500, whichever comes first. Clients paying annually will have their first payment reduced by 25% or $500, whichever comes first. Once a written case is issued and qualifies for a first-year premium reduction, it will not be eligible to qualify again. ADO premium is not covered by the campaign. Clients will be billed for this portion right from date of issue. If a Temporary Insurance Agreement is chosen, it will not be impacted by this campaign and will remain intact.

5 Serenia Life Financial’s member benefits and program are not contractual. They are subject to change and maximum funding limits.

6 PMG Intelligence “Member Satisfaction Research 2022.” Conducted September 2022 on behalf of Serenia Life Financial.

7 For more details, please contact us through Member Services at 1-800-563-6237 or at 300-470 Weber Street North, Waterloo, ON N2L 6J2. You may view our Privacy Policy online atserenialife.ca/privacy-policy/.

* Illustration only, as of January 2025. Age 0 based on female regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $31.28 payable for 20 years. Age 0 based on male regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $31.95 payable for 20 years. All numbers in Canadian dollars.

* Illustration only, as of January 2025. Age 10 based on female regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $39.15 payable for 20 years. Age 10 based on male regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $39.15 payable for 20 years. All numbers in Canadian dollars.

* Illustration only, as of January 2025. Age 15 based on female regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $41.63 payable for 20 years. Age 15 based on male regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $43.65 payable for 20 years. All numbers in Canadian dollars.