CHILD life insurance

A Financial Safety Net That Grows With Them

Set your child up for the future with Serenia Life's Grow With Them Plan.

- It comes with a cash value that grows with your child1 (learn more)

- You'll never find a cheaper time to buy than now (here's why)

- Enjoy access to Serenia Life member benefits – like a baby bonus, post-secondary scholarship, and more... (browse benefits)

- Save up to $500 off on first-year payments (learn more)

Grow With Them Plan Benefits

Seriously Affordable

Because a policy’s cost goes up with age, there will never be a cheaper time to buy than now1. Plus, get up to 25% off your first-year payments with Serenia Life.

Serious Growth Potential

Your child’s policy comes with a cash value2 that can grow significantly over time. They can use it later to help pay for a first car, wedding, a down payment on their home.

Lifetime Protection - Not Payments

With a 20-pay whole life policy, payments stop after 20 years, but your child will be covered for life. This becomes all the more important once they have a family of their own.

$100 Baby Bonus

When you insure a baby (0-12 months), they become eligible for Serenia Life’s Bundles of Joy Benefit3 – a $100 baby bonus for our littlest members.

$1,000 Post-Secondary Scholarship

Once your child reaches an age where they plan to pursue post-secondary education, they can apply for a $1,000 scholarship through Serenia Life.

Bereaved Child Benefit

In the tragic scenario that your child were to lose both parents, Serenia Life would provide them with $500 in monthly support until their 19th year.

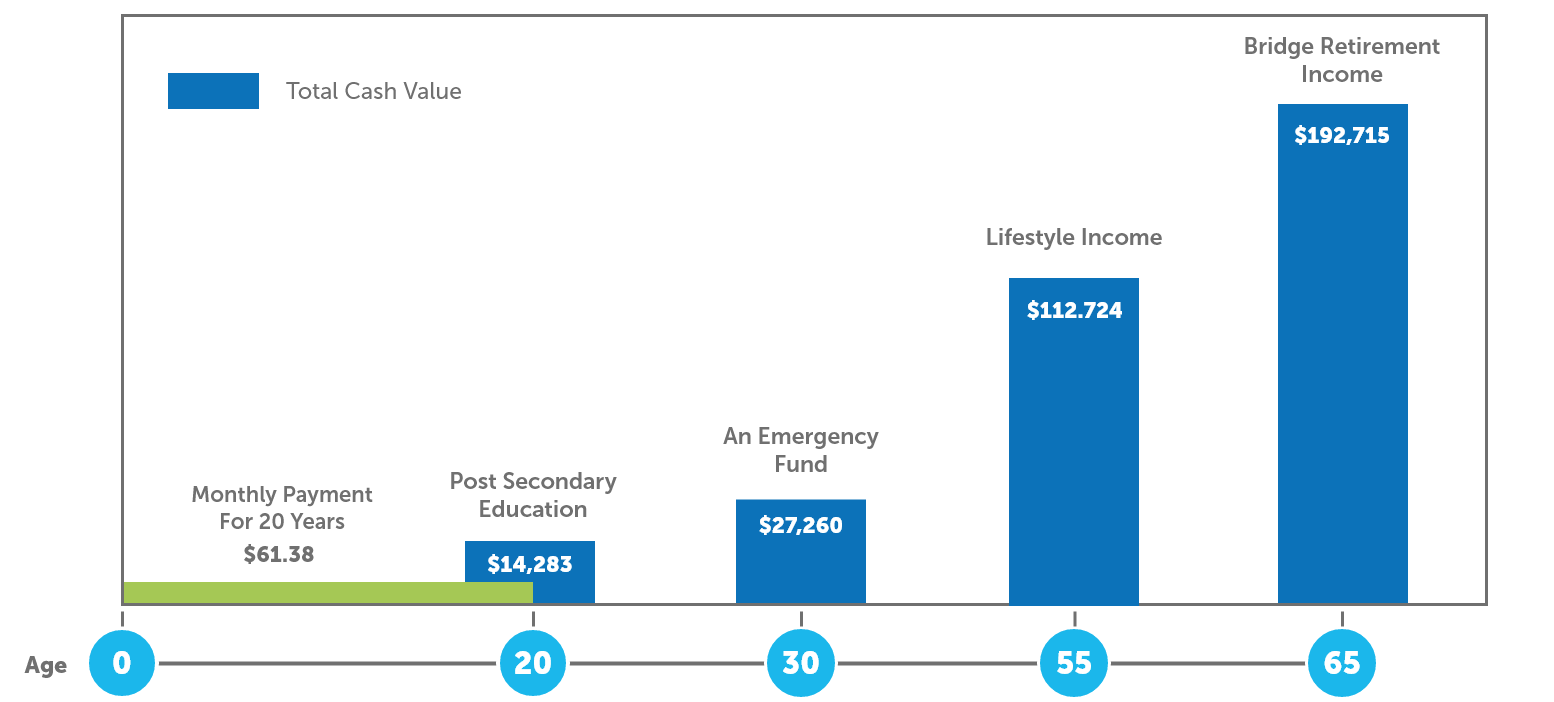

An Investment in Their Future

Susan and Lemar

Susan is looking for a permanent insurance solution for her 6-month-old son, Lemar.

The cheapest time to buy child life insurance is now

Susan is looking for a permanent insurance solution for her 6-month-old son, Lamar.

Overview

- Susan has a maximum budget of $100/month

- She is looking for a policy that will grow as her son does

- She wants a policy with no payments required when her son is an adult

- She wants to ensure that her son's insurance continues even if she passes away

Solution: 20-Pay Whole Life Policy for $50,000

Total Monthly Premiums: $61.38

(This premium includes the Owner Waiver Death and Disability Benefit for a female, age 35)

For illustration purposes only, as of December 2024. Age 0 based on male regular rates, paid up additions dividend option, and on $50,000 initial insurance coverage and current dividend scale. Future performance will be different than illustrated due to the variability of the dividend. All numbers in Canadian dollars. Current monthly premium, age 0 is $57.15 payable for 20 years. The policy is "paid up" at age 20. Susan is 35 years old, so the monthly premium of $4.23 is added to the monthly total of $61.38.

How to Buy Child Life Insurance

Lucky for parents, buying child life insurance is as easy as 1, 2, 3! Follow the steps below and your child will be set up for the future, thanks to Serenia Life’s Grow With Them Plan.

1. Get a free quote

Book a 15-minute call with a licensed advisor by filling out this form. A Serenia Life advisor will reach out to get the ball rolling.

2. Apply for the Grow With Them Plan

We’ll walk you through the application process with some simple questions about your child’s age, health, and your goals for their future.

3. Make your first payment

Once your first payment is made, we’ll set up automatic payments directly from your bank so that you don’t have to worry about a thing.

An Extra Layer of Protection for Parents

Life insurance is there to protect your family if the worst should happen. But what if life takes an unexpected turn while you’re still here?

With Serenia Life Critical Illness Insurance, you can take the time you need if your child is diagnosed with a covered condition. Receive a one-time payout that can be used to cover lost income due to time off work, treatment costs, or travel expenses.

Protection = Peace of Mind

- Get coverage for 26 adult illnesses and an additional 7 child illnesses

- Focus on your child's recovery – not your finances – with a one-time, tax-free payment

- No need to dip into your savings, touch your retirement fund, or worry about refinancing your mortgage

- Plus, you can get your money back if your child doesn't use their coverage during the policy term**

UP TO $500 IN SAVINGS!

Save on all first-year life insurance policies with Serenia Life.

See our terms and conditions below. 6

- Purchase a participating whole life policy for your child or grandchild. You can choose 20-pay or whole life – it’s up to you!

- Name a contingent owner (i.e., someone who assumes ownership of the policy if you, the policyowner, dies). In this case, the other parent or a guardian of the child probably makes the most sense.

- Make the monthly or annual payments until you are ready to pass along ownership to your child or grandchild. The child would then take over the payments – unless you purchased a 20-pay whole life policy and payments have already stopped.

- At a date of your choosing (and when they are legal age), transfer the policy to the child. At this point, ownership is now in their name.

- The beneficiaries on the policy would be updated to the people and/or charitable organization of your child or grandchild’s choosing.

- Your child grandchild can now access the cash value through a policy loan or withdrawal8.

When selecting a life insurance provider, it’s always a good idea to do some comparison shopping. Remember: while it needs to fit into your budget, it’s never just about the cost of a policy – consider the organization’s claims approval rating, financial strength, and online reviews.

At Serenia Life, we’re proud to have a claims approval rating that consistently exceeds 99.9%, and we regularly review our suite of products to ensure they’re competitively priced. Not to mention, just one insurance or investment product comes with more than $3,500 in benefits that help support our members, their community, and the causes they care about. Whether you visit our website, set up a meeting with one of our advisors, or call Member Services for help, you’ll be met with human kindness every step of the way.

Serenia Life's Exclusive Member Benefits9

See a breakdown of the value of Serenia Life’s Member Benefits.

Post-Secondary Scholarship

Take advantage of a one-time $1,000 scholarship towards any year of a full-time diploma, undergrad degree, or graduate program.

Fundraiser Support

Apply to receive up to $300 in seed money to get your child started, plus a post-event donation of $100-$300 to the cause you're supporting.

Bereaved Child

To help provide financial stability to children whose parent(s) have died too soon via $500 in monthly support.

Babysitter Training

Give your 11-15 year-old the opportunity to acquire caregiving skills through an accredited Canadian Babysitting course.

Bundles of Joy

You give your baby the gift of life insurance, and we'll send you a $100 baby bonus. Just be sure to purchase the policy before baby turns 1!

.png)

Safe Communities

Keep kids in your community safe with a safety kit and safety sign that reminds drivers to slow down when neighbourhood children are at play.

.png)

Online Will & Power of Attorney

Create your digital will and power of attorneys (POAs) simply, quickly, and at no cost to you – in 20 minutes or less.

1 Cash values are accessible via a withdrawal, policy loan or surrender. These may be subject to taxation and a tax slip may be issued. Accessing the cash value of the policy will reduce the available cash surrender value and death benefit.

2 As long as your child has not been diagnosed with a health condition.

3 To be eligible, your baby must be insured with Serenia Life Financial for at least 6 months.

4 Dividends are not guaranteed and are paid based on the overall experience of Serenia Life Financial, considering all the risk factors. Dividends may be subject to taxation. Dividends will vary based on the actual investment returns in the participating account as well as mortality, expenses, taxes, lapses, withdrawals, and other experience of the participating block of policies. They have the potential to increase the value of your policy above the guaranteed amount, depending on the dividend option selected.

Additional Deposit Option allows clients to pay an additional premium to purchase paid-up life insurance on the policy. This optional payment is in addition to the required insurance premium. With Additional Deposit Option, clients can enjoy the potential of accelerated tax-preferred growth within their policy. We will not accept an additional premium if it will cause the policy to lose its tax-exempt status

5 This optional benefit is available if you're purchasing life insurance for your child. This benefit ensures your child's life insurance coverage remains in the event event of your death, or if you become totally disabled, for a period of at least 6 consecutive months.

6 All life insurance policies purchased will receive 25% off their first-year premium, up to $500. Clients paying monthly will have premiums waived for the first 3 months or up to $500, whichever comes first. Clients paying quarterly will have their first premium payment waived or reduced by $500, whichever comes first. Clients paying annually will have their first payment reduced by 25% or $500, whichever comes first. Once a written case is issued and qualifies for a first-year premium reduction, it will not be eligible to qualify again. ADO premium is not covered by the campaign. Clients will be billed for this portion right from date of issue. If a Temporary Insurance Agreement is chosen, it will not be impacted by this campaign and will remain intact.

7 KPMG Intelligence “Member Satisfaction Research 2022.” Conducted September 2022 on behalf of Serenia Life Financial.

8 Accessing the policy’s cash value will reduce the available cash surrender value and death benefit.

9 Serenia Life Financial’s member benefits and program are not contractual. They are subject to change and maximum funding limits.

10For more details, please contact us through Member Services at 1-800-563-6237 or at 300-470 Weber Street North, Waterloo, ON N2L 6J2. You may view our Privacy Policy online at serenialife.ca/privacy-policy/.

* Illustration only, as of January 2025. Age 0 based on female regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $31.28 payable for 20 years. Age 0 based on male regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $31.95 payable for 20 years. All numbers in Canadian dollars.

* Illustration only, as of January 2025. Age 10 based on female regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $39.15 payable for 20 years. Age 10 based on male regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $39.15 payable for 20 years. All numbers in Canadian dollars.

* Illustration only, as of January 2025. Age 15 based on female regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $41.63 payable for 20 years. Age 15 based on male regular rates, and on $25,000 20-pay permanent life insurance coverage. Monthly premium $43.65 payable for 20 years. All numbers in Canadian dollars.

**Get the money you paid for your coverage back in the event of policy surrender (ROPS), expiry (ROPE), or death (ROPD); Return of Premiums (ROP) are optional benefits available for an extra cost at the time a policy is issued. Not all ROPs are available for all coverage lengths; speak to a Serenia Life advisor for more information.