mortgage life insurance

Want to save more on insuring your mortgage?

Time to 'think outside of the bank' with Serenia Life term life insurance. Choose a 10, 20, or 30-year term policy to cover the length of your mortgage, and:

- Better protect your loved ones with more flexibility and more benefits for you – not the bank (compare)

- See how Jose and Heather saved 35% when they chose term 30 life insurance (here’s how)1

- Gain access to Serenia Life member benefits – like a baby bonus, post-secondary scholarship, and more... (browse benefits)

What makes term life insurance a better choice?

Affordable, competitive rates

You choose your beneficiary

Protection that moves with you

It can outlive your mortgage

Comparing term life insurance versus mortgage life insurance

| Comparison Type | Term Life Insurance | Mortgage Life Insurance |

|---|---|---|

| Ownership | You own and control the policy. |

The bank owns the policy. |

| Amount of Coverage | Coverage never decreases. |

Coverage decreases as your mortgage decreases. |

| Payment/Premium | Payments remain the same. |

Payments remain the same. |

| Insurance Portability | Refinancing your mortgage has no impact on your coverage. |

Refinancing your mortgage may terminate your coverage.2 |

| Flexibility | You can use your insurance for different purposes. |

Your insurance is for mortgage protection only. |

| Convertibility | Regardless of your health, you can convert the term to whole life insurance without a medical exam, subject to contain conditions. |

Not convertible. |

| Beneficiary | You choose the beneficiary, and they receive the proceeds upon your death. |

The bank is the beneficiary, and the proceeds pay off the mortgage only. |

| Sales Credentials | Your financial advisor is a licensed life insurance advisor, trained to understand your holistic financial needs. |

You work with a financial advisor who may not be licensed to sell life insurance, which can be an important part of a comprehensive financial plan. |

| Added Benefits | Serenia Life member benefits, including a free online will from Willful™! |

Not offered. |

UP TO $500 IN SAVINGS!

Save on all first-year life insurance policies with Serenia Life.

See our terms and conditions below. 3

Jose and Heather

Jose and Heather have purchased a home in Ontario. They want to make sure their growing family is protected against future mortgage payments if one of them were to pass away unexpectedly before the mortgage is paid off.

Overview

- Jose and Heather have a 25-year, fixed-rate mortgage for $750,000 through their bank. The mortgage is paid monthly.

- They each want to ensure that the other is not left with a mortgage if something were to happen to them

- As parents, they also want to avoid uprooting their children in the event they cannot make payments due to loss of income.

Solution:

- Term 30 Life Insurance for $750,000

- Total Monthly Premiums: $125.781

Jose and Heather saved 35% ($68.62) monthly by choosing a term 30 life insurance policy instead of purchasing mortgage life insurance through their bank.1 This decision also ensured that their children would benefit from the policy if they passed away unexpectedly.

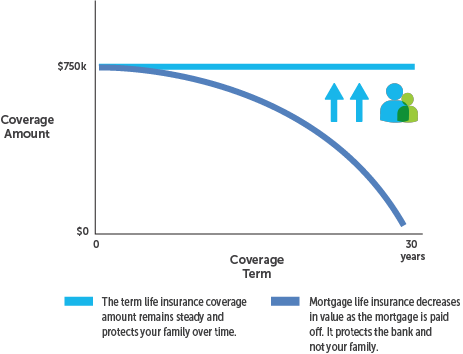

Jose & Heather's coverage over the life of the mortgage

The chart displays a graphical representation of having mortgage life insurance coverage for 30 years versus term 30 life insurance coverage. With mortgage life insurance, your coverage decreases as the mortgage is paid off. However, with term 30 life insurance, your coverage remains steady over the term. In this scenario, the amount remaining after your mortgage is paid off would go to the beneficiaries of the policy (i.e., your loved ones).

This chart is for illustration purposes only.

$1,000 Scholarship

Take advantage of a one-time $1,000 scholarship towards any year of a full-time diploma, undergrad degree, or graduate program.

Fundraiser Support

Apply to receive $150 in seed money to get your child started, plus a post-event donation of $100 to the cause you're supporting.

Free Online Will & Power of Attorney

Serenia Life Financial has partnered with Willful® to give members the opportunity to create their will and appoint power of attorneys (POAs) simply, quickly – and at no cost. Willful is a digital estate planning platform whose easy step-by-step process can be done online in less than 20 minutes.

Testimonial

"After being notified by [my mortgage company] that my mortgage protection would be cancelled when I turn 70 next month, Kathleen was very understanding to my situation. She was polite, professional, understanding, and had a sense of humour. She made me feel very comfortable when weighing my options. She took the time to explain how the process would work going forward. I feel she is an outstanding employee who cares about the caller, unlike “Big " businesses who are after the mighty dollar. I look forward to dealing with Kathleen again in the near future."

⭐⭐⭐⭐⭐

-JW

1 Illustration only, as of February 2024. Age 32 based on female regular rates, and on $750,000 initial life insurance coverage. Monthly premium $53.78 payable for the 30 year term. Age 32 based on male regular rates, and on $750,000 initial life insurance coverage. Monthly premium $72.00 payable for the 30 year term. All numbers in Canadian dollars.

The difference was calculated using RBC's mortgage calculator as of February 2024. Mortgage was amortized over 25 years, paid monthly, fixed-rate of 5.59% for a 5-year term. Mortgage life insurance was added for two people in Ontario based on the oldest age of the borrower at 31-36 years old.

| RBC Mortgage Life Insurance | Term 30 Life Insurance | |

|---|---|---|

| Mortgage Amount | $750,000 | $750,000 |

| Province | Ontario | Ontario |

| Age | Based on the age of the oldest borrower between 31-36 years old. | Based on the age of each individual. |

| Total Monthly Cost | $194.40 | $125.78 |

| Total Savings | $68.62 per month |

2 Refinancing or making changes to your mortgage may or may not result in a loss of coverage. It depends on who you are refinancing the mortgage with. It is best to check with your lender for details.

3All life insurance policies purchased will receive 25% off their first-year premium, up to $500. Clients paying monthly will have premiums waived for the first 3 months or up to $500, whichever comes first. Clients paying quarterly will have their first premium payment waived or reduced by $500, whichever comes first. Clients paying annually will have their first payment reduced by 25% or $500, whichever comes first. Once a written case is issued and qualifies for a first-year premium reduction, it will not be eligible to qualify again. ADO premium is not covered by the campaign. Clients will be billed for this portion right from date of issue. If a Temporary Insurance Agreement is chosen, it will not be impacted by this campaign and will remain intact.

4 PMG Intelligence “Member Satisfaction Research 2023.” Conducted September 2023 on behalf of Serenia Life Financial.

5For more details, please contact us through Member Services at 1-800-563-6237 or at 300-470 Weber Street North, Waterloo, ON N2L 6J2. You may view our Privacy Policy online a serenialife.ca/privacy-policy/.

* Illustration only, as of March 2025. Age 30 based on female regular rates, and on $750,000 Term 30 life insurance coverage. Monthly premium $46.35 payable for 30 years. Age 30 based on male regular rates, and on $750,000 Term 30 life insurance coverage. Monthly premium $63.90 payable for 30 years. All numbers in Canadian dollars.

Illustration only, as of March 2025. Age 40 based on female regular rates, and on $750,000 Term 20 life insurance coverage. Monthly premium $47.70 payable for 20 years. Age 40 based on male regular rates, and on $750,000 Term 20 life insurance coverage. Monthly premium $63.90 payable for 20 years. All numbers in Canadian dollars.

Illustration only, as of March 2025. Age 35 based on female regular rates, and on $750,000 Term 20 life insurance coverage. Monthly premium $31.50 payable for 20 years. Age 35 based on male regular rates, and on $750,000 Term 20 life insurance coverage. Monthly premium $44.33 payable for 20 years. All numbers in Canadian dollars

Illustration only, as of March 2025. Age 45 based on female regular rates, and on $750,000 Term 20 life insurance coverage. Monthly premium $75.38 payable for 20 years. Age 45 based on male regular rates, and on $750,000 Term 20 life insurance coverage. Monthly premium $105.08 payable for 20 years. All numbers in Canadian dollars.